Housing Preservation & Development311

Housing Preservation & Development311 Search all NYC.gov websites

Search all NYC.gov websites

HDFC Cooperatives

HDFC Cooperatives

During the 1970s and 1980s, the City of New York acquired many residential buildings that were abandoned by their landlords and were in financial distress. HPD rehabilitated some of these buildings and, over the years, gave the tenants the opportunity to own their apartments and become shareholders in limited-equity cooperatives organized as Housing Development Fund Corporation cooperatives (HDFC coops). More recently, the City has financed and provided tax exemptions for the new construction, rehabilitation and stabilization of HDFC coops. Today, there are over 1,100 HDFC coops that make up a significant part of the fabric of New York City's affordable housing stock. HDFC coops benefit from reduced real estate taxes in exchange for following income and resale restrictions, among other governance restrictions.

Information and Requirements

Click a topic, or press the enter key on a topic, to reveal its answer.

What is an HDFC coop?

Cooperatives are a distinctive form of housing ownership, which differ from condominium ownership, single-family ownership, or renting. Owners of coop apartments are referred to as “shareholders” because they have purchased shares in a cooperative corporation that owns real property. HDFC coops are incorporated under the New York State Business Corporation Law and Article XI of the New York State Private Housing Finance Law (Article XI) and are subject to supervision by HPD. In HDFC coops all shareholders own an equal number of shares, regardless of the size of their apartment. Shareholders elect a Board of Directors to make decisions about the coop. Typically, a coop Board of Directors is elected annually.

The Board of Directors is legally obligated to act in the best interests of the HDFC and its shareholders. They are responsible for ensuring the financial well-being of the coop, as well as compliance with the law and regulatory restrictions placed on the property, including income, re-sale and subletting restrictions.

HDFC coops are different from market rate coops in that a shareholder’s ability to gain a profit from selling a unit is limited to ensure the continued affordability of the unit to future low-income purchasers.

How do I buy an apartment in an HDFC coop?

Most HDFC coop apartments available for sale are listed like other coops in the city – by shareholders or the coop’s Board of Directors through brokers and real estate websites. Sometimes they are advertised through non-profit organizations. Some HDFC coop availabilities are listed through the City's affordable housing lottery portal, NYC Housing Connect.

Buyers of HDFC apartments must fulfill certain requirements set forth in the law, any document signed by the coop with a governmental agency, and the coop’s governing documents. Requirements for buying into and owning an HDFC coop are described below but are only intended to describe general policies. Shareholders and purchasers should always review an HDFC coop’s documents to confirm the restrictions that apply to the property and may want to consult a lawyer.

What is considered affordable?

Sales prices should be affordable for a family that fits the income restrictions of a particular building. Prices should be low enough so that purchasing households are not generally spending more than one-third (33%) of their income on housing costs, which include mortgage payments, maintenance payments, and utilities. Coops with Regulatory Agreements may have limits on sales prices.

Income requirements

All HDFC coops are incorporated under Article XI and must comply with its requirements. Article XI requires HDFC coops to provide housing for persons and families of low income. Under the NYS Private Housing Finance Law, low income means persons and families whose household income does not exceed 165% of Area Median Income (AMI). However, oftentimes HDFC coops are subject to stricter income requirements in their Deed, Certificate of Incorporation, Bylaws, Offering Plan and Regulatory Agreement (if applicable). Each HDFC must comply with the most restrictive requirements in place.

For information on how to determine a household’s income and applicable AMI, please consult the HPD Marketing Handbook.

Where do I find an HDFC's governing documents

The HDFC’s Board of Directors or property management company should have all the governing documents. The City’s Automated City Register Information System (ACRIS) contains Deeds, Regulatory Agreements, Security Agreements, and Mortgages.

Maximum income determined by AMI level

Some HDFC coops have governing documents or a Regulatory Agreement that determines maximum household income according to the AMI.

The median income for all cities across the country is defined each year by U.S. Department of Housing and Urban Development (HUD). The 2021 AMI for the New York City region is found below. Learn more about AMI.

| Family Size | 30% AMI | 40% AMI | 50% AMI | 60% AMI | 70% AMI | 80% AMI | 90% AMI | 100% AMI | 110% AMI | 120% AMI | 130% AMI | 165% AMI |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | $25,080 | $33,440 | $41,800 | $50,160 | $58,520 | $66,880 | $75,240 | $83,600 | $91,960 | $100,320 | $108,680 | $137,940 |

| 2 | $28,650 | $38,200 | $47,750 | $57,300 | $66,850 | $76,400 | $85,950 | $95,500 | $105,050 | $114,600 | $124,150 | $157,575 |

| 3 | $32,220 | $42,960 | $53,700 | $64,440 | $75,180 | $85,920 | $96,600 | $107,400 | $118,140 | $128,880 | $139,620 | $177,210 |

| 4 | $35,790 | $47,720 | $59,650 | $71,580 | $83,510 | $95,440 | $107,370 | $119,300 | $131,230 | $143,160 | $155,090 | $196,845 |

| 5 | $38,670 | $51,560 | $64,450 | $77,340 | $90,230 | $103,120 | $116,010 | $128,900 | $141,790 | $154,680 | $167,570 | $212,685 |

| 6 | $41,520 | $55,360 | $69,200 | $83,040 | $96,880 | $110,720 | $124,560 | $138,400 | $152,240 | $166,080 | $179,920 | $228,360 |

| 7 | $44,400 | $59,200 | $74,000 | $88,800 | $103,600 | $118,400 | $133,200 | $148,000 | $162,800 | $177,600 | $192,400 | $244,200 |

| 8 | $47,250 | $63,000 | $78,750 | $94,500 | $110,250 | $126,000 | $141,750 | $157,500 | $173,250 | $189,000 | $204,750 | $259,875 |

Maximum income determined by formula (NYS PHFL Section 576)

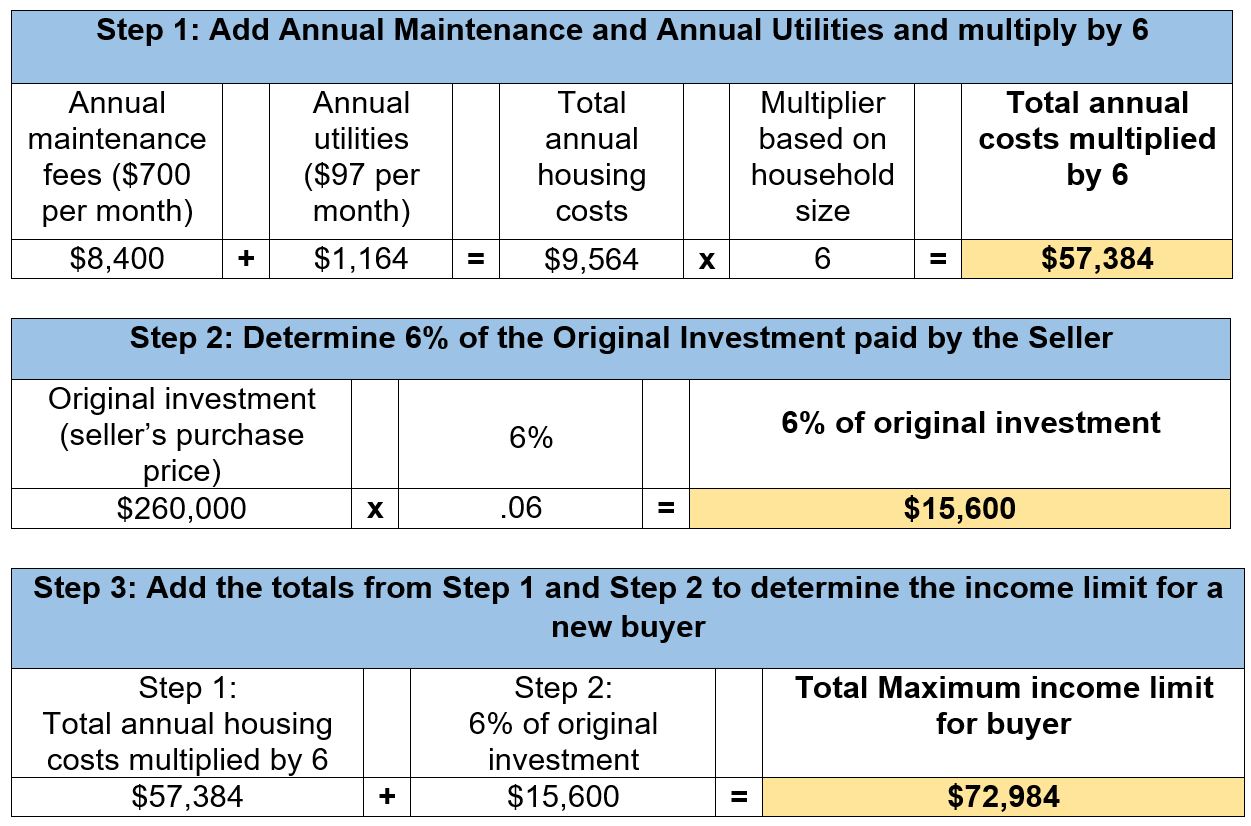

Some HDFC coops may be subject to governing documents or agreements like a Deed that, instead of specifying an AMI level, refers to a formula in Section 576 of the Private Housing Finance Law to determine the maximum income for new shareholders. This formula requires that units be made affordable to new shareholders (i.e. purchasers) that earn no more than 6 (for a 1-2 person household) or 7 (for a 3+ person household) times the annual maintenance fee plus utility costs (please use numbers located under Utility Allowance for utility amounts corresponding to unit size) plus six percent (6%) of the current shareholder’s (i.e. seller’s) original investment.

Outlined below are the steps to calculate the maximum household income in an HDFC coop subject to Section 576 restrictions.

Example 1: 1-bedroom apartment being sold to a 2-person household

Here is an example using the Section 576 formula for determining a new purchaser's maximum income based on the following details:

- Unit size: 1-bedroom apartment

- Monthly maintenance: $700

- Annual maintenance: $8,400 ($700 x 12 months)

- Annual utilities: $1,164 ($97 per month x 12)

- Seller's purchase price ("original investment"): $260,000

- 6% of the original investment: $15,600 (6% of $260,000)

- Purchaser's household size: 2

- Multiplier based on household size (required by the Statute): 6x

For comparison, the 2020 Area Median Income level for a 2-person household earning $72,984 is 80% AMI.

Example 2: 3-bedroom apartment being sold to a 4-person household

Here is an example using the Section 576 formula for determining a new purchaser's maximum income based on the following details:

- Unit size: 3-bedroom apartment

- Monthly maintenance: $900

- Annual maintenance: $10,800 ($900 x 12 months)

- Annual utilities: $1,752 ($146 per month x 12)

- Seller's purchase price ("original investment"): $240,000

- 6% of the original investment: $14,400 (6% of $240,000)

- Purchaser's household size: 4

- Multiplier based on household size (required by the Statute): 7x

For comparison, the 2020 Area Median Income level for a 2-person household earning $102,264 is 90% AMI.

HDFC coops should always refer to their governing documents such as a Certificate of Incorporation, Bylaws and Offering Plan, and any Deed, Regulatory Agreement, or similar document in determining income restrictions. Each HDFC must comply with the most restrictive requirements in place.

For questions regarding income requirements contact hdfccoop@hpd.nyc.gov.

Renting and subletting

Almost all HDFC coops have Certificates of Incorporation that require owner-occupancy, and Article XI states that such corporations must be operated for the benefit of resident shareholders.

Almost all HDFC coops limit subletting. In general, short-term subletting with Board of Directors’ permission is acceptable where the shareholder intends to return to the apartment, but long-term sublets are not permissible. All subtenants must meet the income eligibility requirements of the HDFC coop.

A shareholder should check the HDFC’s governing documents and any agreements binding the HDFC to determine these restrictions. At all times, an HDFC must comply with the requirements of Article XI of the Private Housing Finance Law.

Flip taxes

The sales of apartments in many HDFC coops are subject to a flip tax. This means that when a shareholder sells their apartment, the sale profits are divided between the selling shareholder and the HDFC. A shareholder should check the HDFC’s governing documents (including Bylaws and Certificate of Incorporation), any agreements binding the HDFC, the proprietary lease from the coop, and the share certificate to determine the amount of the applicable flip tax.

A flip tax is very important for the ongoing successful operation of an HDFC coop. The HDFC coop re-invests the flip taxes it collects into capital repairs and other building needs. Using flip taxes to pay for capital repairs and reserves also means that maintenance might not need to be increased as much or as rapidly to pay for such repairs and reserves.

Below are two examples of how to calculate flip taxes:

Example 1 - HDFC with a 70/30 flip tax: where 70% goes to the selling shareholder and 30% to the HDFC

In this example, the flip tax is the same for all sales in the HDFC. The number of years that the shareholder owned unit does not impact the flip tax breakdown.

Shareholder originally purchased the unit for $60,000

Shareholder is now selling unit to an income-eligible buyer for $100,000

Total profit from the sale is: $100,000 - $60,000 = $40,000

Shareholder’s portion of profit is 70% of $40,000 = $28,000

HDFC’s portion of profit is 30% of $40,000 = $12,000

Example 2: HDFC with a 90/10 flip tax: where 90% goes to the selling shareholder and 10% to the HDFC

In this example, the flip tax is the same for all sales in the HDFC. The number of years that the shareholder owned unit does not impact the flip tax breakdown.

Shareholder originally purchased unit for $180,000

Shareholder is now selling unit to an income-eligible buyer for $200,000

Total profit from the sale is: $200,000 - $180,000 = $20,000

Shareholder’s portion of profit is 90% of $20,000 = $18,000

HDFC’s portion of profit is 10% of $20,000 = $2,000

Annual reporting requirements for HDFCs with regulatory agreements

HDFC coops that have signed a Regulatory Agreement with HPD are required to submit certain documents to the Division of Asset Management. Due dates for the annual submission vary and can be found in the Regulatory Agreement text. HDFCs should refer to their Regulatory Agreement for the due date and the list of documents that are required to be submitted each year.

Resources and contact information

Resources

Subsidy Programs

Existing or prospective shareholders may be eligible for assistance through City or State programs listed below:

- HomeFirst Down Payment Assistance Program

- Senior Citizen Rent Increase Exemption (SCRIE)

- Disability Rent Increase Exemption (DRIE)

- Senior Citizen Homeowners' Exemption (SCHE)

- New York State School Tax Relief Program (STAR / Basic STAR)

- Enhanced New York State School Tax Relief Program (E-STAR)

Technical assistance and monitoring services for coops

Neighborhood Housing Services of New York City (NHS) provides free training and technical assistance to HDFCs citywide.

Urban Homesteading Assistance Board (UHAB) offers free trainings every month on a variety of topics for HDFC coop boards and shareholders. View UHAB's monthly calendar.

List of Approved Monitors for HDFC Cooperatives.

Mortgage Servicing and/or Agreement Release Requests

Information sheet for coops seeking a release of their 60/40 Security Agreements.

Coops that are seeking a Mortgage Satisfaction or Subordination need to complete the following form and submit all listed attachments to the Division of Asset Management.

Other Legal Restrictions for HDFC coops

In 2015, the New York State Attorney General published a guidance document outlining the legal restrictions on converting an HDFC to a market rate project:

HPD Financing Programs for HDFCs

HPD administers multiple financing programs to facilitate the physical and financial sustainability and affordability of owner-occupied buildings. The programs listed below provide low-interest financing for capital improvements or they can be used to re-finance existing loans.

- Green Housing Preservation Program (GHPP)

- HUD Multifamily Housing Rehabilitation Loan Program

- Participation Loan Program (PLP)

- HomeFirst Down Payment Assistance Program

Contact

For questions about HDFC coops, including compliance with Article XI or other regulatory restrictions, please contact hdfccoop@hpd.nyc.gov.