The New York City Office of the Actuary311

The New York City Office of the Actuary311 Search all NYC.gov websites

Search all NYC.gov websites

Out and About

January, 2019

"I believe that as overseers of the New York City Retirement Systems, the one thing most of us here have in common, either directly or indirectly, is this - we have the important responsibility to help secure the financial future of our members. To be entrusted with this responsibility is a privilege."

This is how Patricia Reilly, Executive Director of the Teachers’ Retirement System of the City of New York (TRS), began her remarks at the OA’s professional development series. These words served as a helpful reminder to all those in attendance, of the important work collectively being done by both agencies to protect our teachers’ financial security in retirement.

Established by Chapter 303 of the Laws of 1917, TRS replaced the old New York City Teachers’ Retirement Fund, the first retirement system formed with the leadership of New York City’s first Chief Actuary George B. Buck over one hundred years ago. Using statistics to demonstrate the growth of TRS, Ms. Reilly shared that there were just under 21,000 teachers enrolled in TRS in 1917. Now, approximately 209,000 in-service and retired members make up the membership of TRS with a yearly retirement volume of 3,000 members.

Ms. Reilly discussed how she and her team prioritize their work and goals based on a member-centric philosophy, coupled with the slogan 'building better tomorrows,' that binds all the work performed by TRS staff on behalf of its members. To explain this philosophy further, Ms. Reilly shared TRS’ mission, which is to provide the efficient collection of contributions, the prudent investment of retirement funds, the responsible disbursement of member benefits, and the delivery of exceptional levels of member service.

In addition to adhering to the priorities laid out in the mission, Ms. Reilly and her management team want to continually enrich the experience of TRS members when they interact with them. This is being achieved through the implementation of a program, which started in 2014, that modernizes the agency’s three interrelated areas - technology, processes, and people. TRS has begun offering self-service features through a secured, mobile-friendly, updated website, and through electronic communications, and is bringing online a new computer system, Agile Straight-through Pension (ASPEN), slated to be completed in 2021, to better serve their members. Ms. Reilly mentioned that as her staff continues to develop this new computer system, they will work with the OA on setting up a structure to perform some of the more complex business processes, such as complicated benefit estimates that require actuarial input and restorations to active service. TRS’ Human Resources Department is also working on a Strategic Talent Employee Management System (STEMS). This software will help their Human Resources Department oversee the talent component of the agency’s change management strategy.

"It was wonderful to hear not only TRS’ vision going forward but the history and specific examples of how the OA and TRS have worked together on projects for the benefit of our teachers. All active and retired members of NYCRS benefit immensely when there is true partnership and working relationship between the OA and the retirement systems. With TRS, we expect this to continue for many years to come," said Sherry S. Chan, New York City Chief Actuary.

October, 2018

For her continued dedication and support, Chief Actuary Sherry S. Chan was honored at the Uniformed Fire Officers Association’s Inaugural Bravest Scholarship Fund Golf Outing.

When accepting the award, Chief Actuary Chan reflected on how these last three and a half years as New York City’s Chief Actuary has given her many opportunities to experience firsthand what NY’s Bravest really go through.

In recalling the recent loss of a friend who was a firefighter, Chief Actuary Chan said, "In the 2.5 months that ensued that I had remaining with my friend, Tommy, after he was diagnosed with cancer, I saw and felt firsthand that the Bravest risk their lives not only when they run into a burning building, but also every day thereafter because of the hazardous toxins they expose themselves to. In a force of 11,000 members and an additional 17,000 retirees, I’ve learned that all firefighters have to be the bravest to do what they do."

The friend Chief Actuary Chan paid tribute to in her remarks was Thomas Phelan, who prior to becoming a firefighter, was a New York Ferry captain who helped to evacuate hundreds of people from Lower Manhattan on 9/11. Firefighter Phelan died of cancer, March of this year, linked to the 9/11 attack.

Chief Actuary Chan also shared with the attendees her experience with "Firefighter for A Day" at the New York City Fire Academy. "Through simulations I crawled around in unfamiliar surroundings and felt like I couldn’t get enough air in my mask - I’m not sure if I was going to faint first from carrying double my body weight between the boots, the bunker gear, the helmet, and the Scottpak I had on, or from the heat of the 900° fire in the same room I was in. So, what was the most important thing I learned that day? That my job is a lot easier than yours!" said Chief Actuary Chan.

As she closed her remarks, Chief Actuary Chan noted that all firefighters are heroes and it is a privilege to be their Actuary. "We each have our role in serving the City - so you guys keep fighting the fires and I promise you I will keep fighting to properly fund your pensions," said Chief Actuary Chan.

The proceeds of the Golf Outing will be used for scholarships for the families of fallen firefighters and officers.

June, 2018

Over 10 summer interns from the Board of Education Retirement System (BERS) visited the office this summer to learn more about actuarial work and the operations of the New York City Office of the Actuary.

The BERS summer intern group included high school students and college students majoring in a variety of subject areas such as finance, accounting, international business, and engineering at colleges and universities here in New York City and beyond.

After a welcome and general description of actuarial work by Chief Actuary Sherry S. Chan, OA Actuarial Specialists from both the Valuation Division and Certification Services Division of the office described the work of the OA. Actuarial staff described how their work helps to make sure the pension plans of BERS, and all New York City pensions, are properly funded and the proper steps are taken by OA staff members to certify a BERS participant’s pension upon retirement.

Through a PowerPoint presentation, graphics were used to describe and provide background on the funding components - employee contributions, employer contributions, and returns on investments - of New York City’s public pension plans. The presentation also described how pension amounts are determined upon retirement and how the City takes care of public workers who are disabled through disability benefits or death benefit payments through their beneficiaries. A case example was used to show the steps that are taken to certify pension benefits for New York City Retirement System (NYCRS) participants upon their retirement. The OA certification process makes sure that the pension amounts a retiree of any NYCRS is set to receive adequately reflects what they were promised.

June, 2018

The Young Consulting Actuary High Achievement Award given by the International Association of Consulting Actuaries (IACA) was bestowed upon New York City Chief Actuary Sherry S. Chan in Berlin, Germany on June 6.

This award is given to one actuary worldwide every two years. The 2018 award is the third time this young consulting award, named the Geoffrey Heywood Award, was presented. Chief Actuary Chan received this award at the IACA Biennial General Meeting which took place at the 2018 International Congress of Actuaries. She is the first actuary from the United States to receive this award.

The award is named after the founding Chairman of IACA and is given to a consulting actuary, under the age of 40, who has provided significant services to the public and the actuarial profession. The intent of this award is to help bring the consulting actuarial profession into the public domain and to encourage the successful development of consulting actuarial practices and actuarial literature.

In her acceptance speech, Ms. Chan described her parents’ emigration to the United States when they left behind China’s Cultural Revolution to start a new life. With no professional skills and limited English skills, her parents worked in the kitchen of a Chinese restaurant for many years. Her father went on to become Executive Chef managing a kitchen staff of 40 individuals and together her parents became co-owners of the restaurant which launched a publicly traded IPO. Ms. Chan’s parents made a good life in the US after many long hours and hard work.

Ms. Chan mentioned one moment in her life when she told her father she was disappointed because he couldn’t be at a school event where she was winning an award. “It wasn’t until many years later I overheard my dad telling a friend how difficult running a big restaurant can be and there were many moments of his daughter’s life he had to miss because of it. I then realized how my comments about the school event made him feel and that he was only trying to give me the better future he himself was trying to pursue when he left everything behind in China to literally start from scratch in the US,” said Sherry S. Chan.

May, 2018

After applauding her public service colleagues, thanking her Mom and Dad for teaching her determination and compassion, and reminding the audience that each person is uniquely worthy and important, Chief Actuary Sherry S. Chan accepted the Community Hero Award from Assemblymember Yuh-Line Niou at her Asian American and Pacific Islander Heritage Month Celebration.

Featuring family activities, food vendors, and entertainment, this community-wide celebration took place on May 20th at Confucius Plaza in Manhattan’s Chinatown.

Wen Zhou, CEO of Phillip Lim 3.1; Jiayang Fan, a writer for The New Yorker; and in memoriam, Ricky Leung, a well-known Chinatown/Two Bridges leader who died earlier this year, were also honored.

First recognizing Deputy Inspector Tommy Chan, Commanding Officer of the 5th Precinct for his dedication to the neighborhood’s safety and Assemblymember Yuh-Line Niou for her steadfast support for the Asian American and Pacific community, Chief Actuary Chan devoted the remainder of her remarks to reminding everyone of their value.

"Sometimes it’s so easy to forget how worthy and important each one of us are. Maybe you think that because we are the ones honored today, that we’re in another stratosphere. But guess what? I guarantee you that each one of us got here because we had help or guidance along the way," commented Chan. "Ladies and gentlemen, every single one of you are important and successful in your own ways " remember that," continued Chan.

Appointed in May of 2015, Chief Actuary Chan is the first woman of color to be the New York City Chief Actuary.

March, 2018

658 reports, 99 testimonies before Congress, and 1,414 new recommendations. These numbers represent just some of the work performed last year by the U.S. Government Accountability Office (GAO).

The GAO’s work is impactful. Seventy-six percent of their recommendations, made four years ago or earlier, were implemented by the agency responsible.

Frank Todisco, the second GAO Chief Actuary and the only actuary on staff until 2015 when a pension and health actuary were hired, spoke to the OA Staff as part of our professional development series. Frank gave an overview of the GAO and enlightened the staff on actuarial duties and projects being performed in another level of government, namely the federal level.

"When Frank spoke to us he commented on the value of an actuary in governmental operations. I couldn’t agree more," said Sherry S. Chan, Chief Actuary. "Frank noted that although actuaries sometimes develop a niche expertise like pensions or health care, general actuarial training makes you prepared to assist and provide a broader perspective in many subject areas within government," continued Chan.

What is the U.S. GAO?

The U.S. GAO, established in 1921, works for the United States Congress and is considered the investigative arm of Congress. The agency is charged with improving the performance and ensuring the accountability of the federal government to the American people. The GAO receives direction and work through a variety of sources: requests by Congressional Committee Chairs or by ranking members of a Congressional Committee; a legislative mandate; or through statutory authority provided to the head of the agency, the Comptroller General.

Duties of the U.S. GAO:

- Regularly audits the financial statements of the U.S. government.

- Investigates all matters relating to receipt, disbursement, and application of public funds.

- Audits agencies in the Executive Budget, investigates allegations of illegal or improper acts, and reports on how well

government programs and policies are meeting objectives.

Work performed by the Chief Actuary Todisco and his team:

- Reporting directly to the Comptroller General, the Chief Actuary, reviews, edits, and drafts the actuarial sections of the

GAO reports.

- Performs the technical review for many GAO reports.

- Serves as the expert consultants to the mission teams of the U.S. GAO, as well as to members of Congress and Congressional

staff. There are 14 GAO mission teams and they are organized by subject matters such as health care, national defense, pensions, and education.

Work performed by the Chief Actuary Todisco and his team:

- The office maintains a "high risk" list which includes 34 federal areas/agencies that need assistance in improving their

operations.

- The agency has just issued two reports involving the Central States Pension Fund, a trucking industry multi-employer pension

plan covering members of the International Brotherhood of Teamsters union. Among other topics, the reports examine the factors that contributed

to the plan’s critical financial condition.

February, 2018

The newly appointed Executive Director of the New York City Employees’ Retirement System (NYCERS), Melanie Whinnery, visited the OA to give the staff a presentation on the history and background of NYCERS and the goals she has for its 350,000 active and retired members.

Melanie also provided information on the New York State & Local Retirement System (NYSLRS) where she previously served as their Deputy Comptroller and Chief Operating Officer prior to going to NYCERS. NYSLRS is the third largest retirement system in the nation with 346 benefit plans as compared to NYCERS, which has 64 plans. NYCERS is the largest municipal retirement system in the country, and is governed by a Board of Trustees consisting of representatives from the City, elected officials, and various unions. NYSLRS, on the other hand, is governed by the State Comptroller, who is the sole trustee and the administrative head of the system. Instead of a Board of Trustees, five advisory committees make recommendations to the State Comptroller on the formulation of policies in relation to the administration and management of the Common Retirement Fund and the Retirement System.

Melanie discussed the various tiers within NYCERS and the features available to members such as buying back previous public service so it can be included in the calculation of retirement benefits. Melanie also described the System’s premiere project, the Legacy Replacement Project (LRP), a multi-year effort to modernize and optimize NYCERS’ administration of retirement benefits. The project will focus on pension administration software and system integration to fine tune the business processes of NYCERS and further enhance the System’s customer service capabilities. For example, NYCERS will be installing an Interactive Voice Response system which will be well equipped to address members’ general questions, and thereby allowing customer service resources to be better used for more elaborate issues and questions on individual retirement matters. The overall goal of LRP is to deliver a world class client experience, demonstrate the value of retirement planning, maintain secure systems and reliable operations, and achieve operational excellence.

Melanie reported that NYCERS staff members are very pleased with the new process used to share information with the OA when the pension benefits of a NYCERS member are being certified upon retirement. Information is now shared electronically instead of through paper files and it has been well received by the NYCERS staff.

February, 2018

Ten students from the University at Buffalo, the State University of New York, visited the OA to learn about the work of a public pension actuary. The students, predominantly seniors majoring in mathematics with a concentration in actuarial science, were participating in a trip organized by the University’s Actuarial Science Club to visit several New York City actuarial organizations.

Several OA staff members spoke to the group including Chief Actuary Chan, newly hired Actuarial Specialists Nanda Mlloja and Joseph Lebel, and Gregory Zelikovsky, the actuary who oversees the issuance of OA fiscal notes which are analyses that outline the costs resulting from any proposed pension legislation altering NYC pension benefits.

Chief Actuary Chan kicked off the presentation describing the professional positions she has held in the actuarial field throughout her career and giving advice to the students on how to be successful actuarial students and ultimately successful actuaries. Both Nanda and Joseph described the mission and responsibilities of the OA and shared their personal experiences as actuarial students and offered suggestions on how to prepare for a career as an actuary. Gregory described the fiscal note process and its role in helping legislators decide on pension legislation before voting on them. He also discussed the rewards and challenges of public pension actuarial work.

The students had the opportunity to ask specific questions about preparing for a career as an actuary, focusing on topics such as how to prepare for the industry actuarial exams and when to take them, how to pursue employment in the field, and what types of employment opportunities are available for actuaries. The students gave some feedback after the presentation stating that they enjoyed learning about public pension actuarial work and now have a better understanding of the type of work done by public pension actuaries and the opportunities available in the field.

January, 2018

John Adler, the Director of the Mayor’s Office of Pensions and Investments (MOPI), was the guest speaker at the OA’s first 2018 LEARNy, the office’s professional development series.

As the Director of MOPI, John is the Mayor’s Chief Pension Investment Advisor providing guidance and support as the Mayor’s trustee on the Boards of the major retirement systems of New York City and the NYC Deferred Compensation Plan Board. MOPI monitors and advises on the performance of investments and investment managers for all asset classes held by the City’s pension funds and Deferred Compensation Plan. The goal is to ensure that the asset allocation of the City’s pension funds is diversified to reduce risk. The Mayor’s Office of Pensions and Investments is also responsible for reviewing each accidental disability filing for the retirement systems.

John’s presentation focused on the make-up of the Boards of Trustees of the five major retirement systems: the New York City Employees’ Retirement System, the Teachers’ Retirement System of the City of New York, the Board of Education Retirement System, the New York City Police Pension Fund, and the New York City Fire Pension Fund. The Mayor’s Office is represented on each of these boards except for BERS, and by statute, as the Mayor’s representative, John is the Chairman of the Board of the New York City Employees Retirement System. As explained by John during his presentation, each of the five Boards of Trustees are comprised of representation from City officials and union officials, where the unions represent the system’s members. To make decisions on issues, the retirement boards, in addition to having a majority vote, need at least one vote from the City side and one vote from the union side.

Prior to Mayor DeBlasio appointing him to this position in 2015, John was the Director of the Retirement Security Campaign at the Service Employees International Union.

January, 2018

Looking to obtain a broader perspective on the responsibilities and challenges faced by those she serves as the caretaker of their pensions, Chief Actuary Chan recently enrolled in the International version of the NYPD Citizens Police Academy held at the 5th Precinct in Chinatown.

The mission of the Citizens Police Academy is to educate the public about NYPD’s work so citizens have a better background and appreciation of the role of police officers in their community. The Academy helps to improve police and community relations by providing an opportunity to understand the actions and reactions of police officers in the communities they serve.

"It’s important to try and walk in the shoes of those I serve. I once had the opportunity to take part in a fire simulation exercise organized by the New York City Fire Department. It provided me with a real-life appreciation of the challenges of fighting a fire. So, when I heard about the Citizens Police Academy, I jumped at the opportunity to learn more about the service performed by New York’s Finest," said Chief Actuary Chan.

Chief Actuary Chan listened to speakers discuss topics such as bullying, domestic violence, and COMPSTAT, a performance management tool started by NYPD but now used by police departments nationwide to reduce crime. The training concluded with a graduation held in Chinatown with Chief Thomas M. Chan, NYPD Chief of Transportation, and Deputy Inspector Tommy Ng, Commanding Officer of the 5th Precinct, presenting graduation certificates to approximately 50 Academy participants.

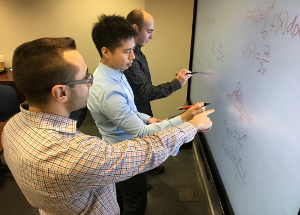

December, 2017

Actuarial Specialists John Stroumbos, Daniel Khalilov, and Crage Lu recently passed actuarial exams, thereby advancing their efforts in becoming credentialed actuaries. By passing a set of rigorous exams and other requirements administered by the Society of Actuaries, actuarial students, those working in the actuarial profession and at the same time studying and taking exams, become credentialed actuaries. These Actuarial Specialists have progressed toward becoming ASAs or Associates of the Society of Actuaries.

These students have devoted hundreds of hours to properly prepare for their exams and online learning requirements. The Society of Actuaries (SOA), a professional organization for actuaries based in North America, is one of the professional actuarial associations that governs actuarial credentialing. Acquiring actuarial credentials has widespread recognition in the field and offers professional distinction. The actuarial skills and knowledge gained through the examination and credentialing process form the basis for actuarial work at the OA and supplement the knowledge base gained on the job.

November, 2017

While in Washington D.C. attending both an American Academy of Actuaries Pension Practice Council meeting and the Academy Annual Meeting, Chief Actuary Chan took some time to visit the Social Security Administration (SSA) to speak to their actuarial staff about the work of the New York City Office of the Actuary (NYCOA).

With both the SSA and the NYCOA responsible for taking care of systems that provide important income in retirement, Chief Actuary Chan shared background information on the work of the NYCOA to highlight the similarities between both offices and their missions.

Chief Actuary Chan explained the mission and structure of the NYCOA and the responsibilities and services provided by the staff to the five major actuarially-funded NYC Retirement Systems and Pension Funds such as the pension valuation work, certification of benefits, and fiscal note preparation. Preparing the financial impact of proposed legislation on pension changes, known in New York City and State as a fiscal note, so legislators understand the cost of the item they’re voting on, is an important function of both agencies. Following the presentation, both agencies discussed the similarities in providing financial impact analysis since both the SSA and the NYCOA handle a significant volume of requests in this area.

Chief Actuary Chan also discussed the political process of successfully adopting proposed pension improvements with labor and political leaders as in the recent calculations for pension disability enhancements for some New York City uniformed personnel.

Additionally, as the Chief Actuary for the largest municipal plan in the United States, Chief Actuary Chan cited examples of how she uses her role to provide a voice for defined benefit plans in the never-ending debate on the viability of state and local pension plans nationwide. Chief Actuary Chan uses public speaking appearances, editorial press pieces, and information shared on the NYCOA Twitter page, to provide insight and documentation on the sustainability and value of defined benefit plans for public workers, not only in NYC, but nationwide.

November, 2017

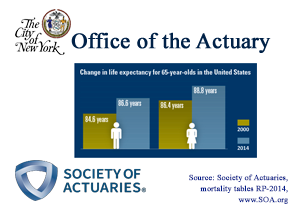

Social Security Administration’s Chief Actuary Stephen Goss, along with the Deputy Chief Actuary Karen Glenn, visited the NYCOA and delivered an insightful overview of the Social Security program as part of the NYCOA’s ongoing professional development program. The presentation included sharing information and discussing issues that impact both the Social Security program and the New York City Retirement Systems and Pensions Funds (NYCRS) such as recent mortality experiences and possible trends, the application of COLA in calculating benefits, the use of actuarial sound principles to consistently monitor the revenue to meet the cost of benefits, and the factoring of Social Security payments when calculating NYCRS benefits.

Additionally, the staff of the NYCOA learned about the two legally distinct trust funds administered by Social Security: the OASI, Old-Age and Survivors Insurance, and the DI, Disability Insurance. Chief Actuary Goss and Deputy Glenn described the funds’ pay-as-you-go financing system, the contingency reserve, and the changing age distribution resulting from a permanent drop in birth rates after 1965.

As stated in their 2017 Social Security Trustees Report, as of December 2016, about 61 million people were getting benefits and Social Security had $2.85 trillion in asset reserves; however, the program’s reserves will be depleted by 2034 if Congress does not take steps to address the situation. The Social Security Administration released a report in October of 2017 outlining a broad range of provisions, approximately 150, that would change the Social Security program and address trust fund solvency. Proposals include changes to the cost-of- living adjustment, level of monthly benefits, retirement age, family members, payroll taxes, coverage of employment, trust fund investment in equities, and taxation of benefits. This summary of provisions also includes the resulting financial effects of each proposal. Chief Actuary Goss noted that historically Congress has always acted in time to avoid reserve depletion.

"I am appreciative to the leading Social Security actuaries for taking the time to share their actuarial experiences and challenges with my staff. Although our responsibilities focus on two different programs, we share a lot in common, especially our dedication to maintaining sound retirement plans for our participants," said Sherry S. Chan, Chief Actuary.

To view the entire PowerPoint presentation made to the NYCOA staff, please visit this link

November, 2017

The Society of Actuaries (SOA), a professional organization for actuaries based in North America, is one of the professional actuarial associations that governs actuarial credentialing. Through successful completion of exams, actuarial students become credentialed actuaries through years of hard work and study. These credentials have widespread recognition in the field and in the world and offer professional distinction.

In an effort to support and give back to the profession by helping others advance their careers by becoming more credentialed, NYCOA Administrative Actuaries, Craig Chu and Carol Hasday, recently served as proctors for SOA actuarial exams.

The two proctored exams, administered in early November by the Society of Actuaries at Manhattan’s Downtown Conference Center, were advanced-level exams and in many cases one of the final barriers to full credentialing by the SOA.

Both Craig and Carol are Fellows of the Society of Actuaries and Enrolled Actuaries. In addition to the variety of actuarial work and services they perform at the NYCOA, Craig oversees the exam study program for actuarial students here. Carol is the resident historian and has documented the history of the OA, in particular the pioneering pension work performed by New York City’s first Chief Actuary, George B. Buck.

October, 2017

Joined by friends, colleagues, and representatives of the NYCRS family, Chief Actuary Chan received the City & State 2017 "40 under 40 Rising Star" award at a reception on October 25th at The Sky Room in Manhattan.

"Although there is no greater honor than serving the members of the New York City Retirement Systems by taking care of their pensions, this honor certainly comes close! Thank you to City & State for this recognition and congratulations to many of my colleagues in government who received this recognition with me. New York City government was well represented in the 2017 class!"

In addition to Chief Actuary Chan, staff members from Mayor’s Fund to Advance New York City, New York City Public Advocate’s Office, New York City Mayor’s Office of Recovery and Resiliency, New York City Mayor’s Office of Minority and Women-Owned Business Enterprises, Office of New York City Comptroller Scott Stringer, New York City Councilman Mark Levine, and New York City Conflicts of Interest Board were also named a 2017 City & State "40 under 40 Rising Star."

Congressman Hakeem Jeffries gave the keynote address at the reception and in his remarks he challenged all the honorees by stating, "A little rebellion is a good thing every now and then. What will history say about how these rising stars responded in the midst of a storm?"

October, 2017

Organized by the US-China Business Training Center, 25 Chinese professionals from the National Bureau of Statistics for the People’s Republic of China and similar type agencies from China’s major cities and provinces, visited the NYCOA. Looking to gain some knowledge and perspective on the actuarial practices and management of public pension plans, the delegation met with New York City Chief Actuary Sherry S. Chan to learn more about her role and responsibilities in safeguarding the five major actuarially-funded New York City Retirement Systems and Pension Funds.

Chief Actuary Chan provided details on many aspects of New York City’s retirement systems including the OA’s status as an independent, non-mayoral agency, and its mandate to provide certain actuarial services to the five major pension funds. Discussions also centered around the make-up of the Boards of the retirement systems and the different pension tier structures, actuarial assumptions and audits, the difference between a defined benefit and a defined contribution retirement vehicle, as well as the OA’s role in producing fiscal notes.

"Time and time again, New York City is where people turn to gain knowledge about government practices. It’s always my pleasure to represent New York City in interactions with national, and in this case, international leaders and practitioners in the industry. I was happy to hear at the conclusion of our discussions that they enjoyed the visit and learned a great deal about the Chief Actuary’s role in the financial health of the well-deserved pensions of our public workers. As a Chinese-American, it was also very humbling to interact with peers from my own heritage and learn how proud they are that an Asian-American is serving in the role as Chief Actuary for the fourth largest retirement system in the country," said Sherry S. Chan, New York City Chief Actuary.

According to a report by the Society of Actuaries and LIMRA Secure Retirement Institute, titled, "The Future of Retirement in China/ History, Systems, and Review," China has an estimated 3,000 provincial, territorial, and city pension funds managed by local governments that adapt retirement policies for the economic needs of their cities. Public pension benefits vary depending on where you live, on employer type (public or private), and on status as an urban or rural resident.

The US-China Business Training Center is a China State Administration of Foreign Experts Affairs (SAFEA) certified provider of professional training programs for Chinese officials, industry professionals, and business executives. The Center arranges visits with institutions, universities, and speakers across the United States for Chinese delegations in an effort to facilitate academic, business, and cultural discussions.

October, 2017

The current and two past New York City Chief Actuaries were participants in a panel for NYCOA staff as part of the office’s professional development series. Current NYC Chief Actuary, Sherry S. Chan, appointed in May of 2015, was joined by her predecessors, former NYC Chief Actuary Robert North, who served from 1990 to 2014, and former NYC Chief Actuary Jonathan Schwartz, who served from 1974 to 1986.

Prior to the presentation, NYCOA staff members had the opportunity to submit questions for the panelists to address. These questions covered a variety of topics, such as the panelists’ career path, reasons and background on why the panelists took the NYC Chief Actuary job, accomplishments during their tenures as Chief Actuaries, challenges faced by the panelists during their tenures, and advice for the current NYCOA staff.

"Through guest speakers, both internal and external, we routinely invest time to encourage professional and personal growth. Inviting back a bit of history to our office, through hosting a NYC Chief Actuary Panel, gave us all some perspective and insight into the challenges and opportunities faced by leaders of the NYCOA. The remarks, personal stories, and advice were enlightening and helpful to the entire team," said New York City Chief Actuary Sherry S. Chan.

Pictured here with the Chief Actuaries (from left to right) - Sherry Chan, Bob North, and Jonathan Schwartz - is actuarial specialist, Vijay K. Kohli (far left), who is the supervisor of the NYCOA’s Certification Services Division. Vijay has served the NYCOA for 33 years and is the sole NYCOA staff member who has worked under all three Chief Actuaries.

September, 2017

The Director of Communications for the New York City Office of the Actuary, Marlene Markoe-Boyd, was invited to speak at a Public Relations Writing course at St. John’s University, Staten Island Campus. Ms. Markoe-Boyd’s presentation to a group of predominantly third and fourth year Communication students included background about the work and mission of the NYCOA, an overview on how the pension funds of the five major New York City Retirement Systems are funded, the communication plans and goals of the office, and the sharing of some fundamental best practices of the public relations profession. Following the class students were instructed to write a press release on the presentation including information on the NYCOA and its public relations efforts.

August, 2017

Members of all U.S. based actuarial organizations are bound by a Code of Professional Conduct that guides professional behavior and practices. The New York City Office of the Actuary maintains a strict policy of following this code in all of the actuarial services it provides.

Actuarial Standards of Practice, commonly referred to as ASOPs in the actuarial field, form an integral part of this Code of Professional Conduct. ASOPs, developed by the Actuarial Standards Board, provide guidance and direction for actuarial work performed in the U.S.; they identify what an actuary should consider, document, and disclose when working on an actuarial project. These “best practices” guidelines are designed to protect both the public and the profession as they set professional standards helping actuaries validate, substantiate, and document their reasoning.

In an effort to continually sharpen skills and practices on the application of ASOPs, OA staff recently participated in a professional training and development exercise focusing on these ASOPs. Each staff member of the OA was assigned to a team, and working collaboratively, each team considered a case study and its relation to ASOP 35: Selection of Demographic and Other Noneconomic Assumptions for Measuring Pension Obligations. During an office-wide staff gathering, each team answered their particular question through presentations that included a variety of creative and visual techniques. The goal of each presentation was to explore issues related to the ASOP, promote teamwork and collectively educate each other on the application of ASOP 35 principles in pension related scenarios, including those that staff at the OA might encounter on a day-to-day basis.

"From the individual group planning meetings to the presentations themselves, this exercise encouraged cross-divisional interactions and helped us develop and maintain best practices that apply to the important actuarial role we play in monitoring and sustaining the financial health of the City’s pension funds" said Sherry S. Chan, Chief Actuary.

July, 2017

The New York City Office of the Actuary (NYCOA) is serving on a committee charged with studying mortality in public pension plans. The committee is being led by the Society of Actuaries (SOA) Retirement Plans Experience Committee (RPEC) and it is the first time a study has focused exclusively on an analysis of mortality for public service employees. The Public Pension Mortality Study is analyzing a dataset of approximately 45 million life years which covers public service employees over a five year period. In order to review potential variations in mortality rates within this population, the committee is currently undergoing a multivariate analysis to include variables that may affect mortality, such as job classification and geographic region. The committee expects to issue an exposure draft report in the fall of 2018 with the issuance of a final report in the spring of 2019. There will be several months dedicated to an exposure period to allow for the study to be reviewed within the industry.

Mortality studies attempt to predict life expectancy and death rates; therefore they are a resource often used by actuaries to help determine the level of funding a pension plan needs to fulfill their commitments to members.

Frankie Chen, Administrative Actuary, is the staff member serving on this committee as a representative of our office.

May, 2017

On Wednesday, May 10, Mayor Bill de Blasio and First Lady Chirlane McCray honored Hasan Minhaj at the Asian-Pacific American Heritage Reception at Gracie Mansion. Minhaj is an American comedian of Indian descent who most recently performed at the White House Correspondents Dinner.

New York City’s Chief Actuary Sherry Chan joined several other Administration officials in attendance including Mayor’s Office of Immigrant Affairs Commissioner Nisha Agarwal; Department of Youth and Community Development Commissioner Bill Chong; NYC Taxi and Limousine Commissioner Meera Joshi; NYC Housing Preservation and Development Commissioner Maria Torres-Springer; and Mayor’s Office of Contract Services Michael Owh.

May, 2017

Along with 48 seasoned executives and emerging leaders, Gregory Zelikovsky, an Actuary with the NYCOA, graduated from the Leadership Institute, one of New York City’s Executive Development Programs. The Citywide Executive Development Programs provide specialized development and networking opportunities for seasoned executives and emerging leaders within City government.

These programs offer participants the unique opportunity to work with and learn from current executive and senior-level City managers; recognized thought leaders and authors; as well as leadership practitioners from academia, government, and the private and nonprofit sectors. The talent of both the faculty and program participants distinguishes these programs as premier development opportunities in City government.

April, 2017

Chief Actuary Sherry Chan, with members of her leadership team, Sam Rumley, Deputy Chief Actuary and Keith Snow, General Counsel, along with the office’s Director of Communications, Marlene Markoe-Boyd, participated in a Master of Science in Actuarial Science ProSeminar at Columbia University.

Through a PowerPoint presentation and a question and answer session following individual remarks, each member of the team discussed his or her duties with the Office of the Actuary, sharing examples of the types of work and challenges they each face in providing actuarial services to the City’s five major retirement systems and pension funds. Approximately 100 students attended the ProSeminar.