Office of Labor Relations311

Office of Labor Relations311 Search all NYC.gov websites

Search all NYC.gov websites

The Deferred Compensation Plan

DCP Videos

Videos are added on a regular basis. Please check back often.

Net-Pay Calculator

This online calculator provides a comparison of your current net-pay with the amount that you would take home based on the contribution percentage that you are considering.

The Power of Compound Interest

It's not only about how much you put in, but how soon you start. That's because of the power of compound interest.

Should I Take My Money out of the Plan When I Leave City Service?

You do not need to immediately contact us or withdraw your funds upon severance from City service. This video hightlghts 5 reasons why you just might decide it’s best to leave your money in the Plan rather than take it out.

Required Minimum Distributions

When you reach a certain age, the IRS requires you start taking Required Minimum Distributions (RMDs) out of your retirement accounts each year.

Learn more about when you must begin taking RMDs, how they work and more.

Play the Video

Retirement is Almost Here

Head into your retirement with confidence! This video touches all the bases - pension, health coverage, union benefits, Deferred Compensation, financial wellness - and lays out a plan for this exciting, transition, so that you may enjoy a comfortable retirement.

Play the Video

Differences between Pre-tax and Roth

There are two tax-advantaged ways of saving in the NYC Deferred Compensation Plan; either on a Pre-tax or Roth basis - or both! This video explains the basic differences between the two contribution types.

Preparing for Retirement

Getting ready to retire? This video will provide you with easy-to-follow instructions and all the ingredients you will need to make yourself a comfortable retirement.

The Right Blend for Your Retirement

This video explains how the NYC Deferred Compensation Plan is an excellent choice as a third stream of income to supplement a pension and social security throughout retirement.

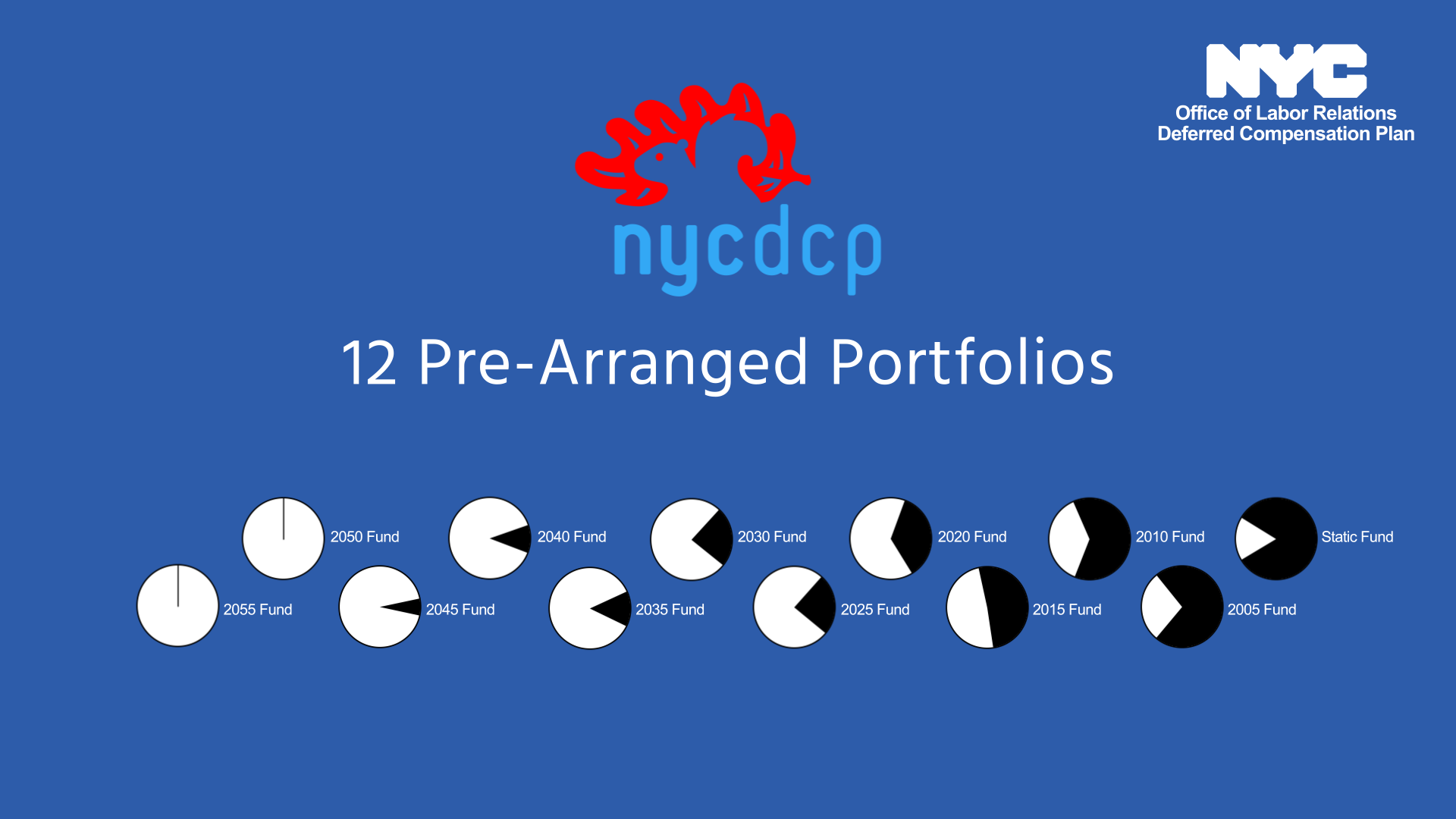

Understanding DCP's Pre-Arranged Portfolios

The Deferred Compensation Plan makes investing easier for you by offering 12 pre-arranged portfolios. Selecting a single pre-arranged portfolio can give you a diversified portfolio professionally managed to your stages of life. This video explains how the pre-arranged portfolios work.

DCP in Lieu of FICA

Employees who are not a member of a pension system and who elect to contribute 7.5% or more to the Deferred Compensation Plan will not pay Social Security (FICA tax). Watch this video to learn more about contributing to Deferred Comp in lieu of paying FICA tax.

DCP Loans

These videos will help answer many questions you may have about how much you can borrow, how loan repayments are made, the consequences of taking a loan on your account balance over time and much more.

DCP Basics

The New York City Deferred Compensation Plan (DCP) is a tax-favored retirement savings program available to New York City employees. The Plan is comprised of two programs: a 457 Plan and a 401(k) Plan and is an essential part of your retirement income.

How to Pick DCP Beneficiaries

When you enroll in DCP, you'll need to pick who receives your account if you pass away. In the event of your death, DCP accounts are distributed according to your beneficiary elections, so it's really important to consider WHO those beneficiaries should be.

Withdrawing Assets

How and when you take your money out of the Plan may be the most important decision you make as a DCP participant so be sure you have a clear understanding of your options before you begin distribution.

NOTE: Use the left menu (when visible) to jump to specific topics.

DCP Online Account "How-to" Video Series

You can view and make changes to your Deferred Compensation Plan account at any time by accessing your account online at nyc.gov/deferredcomp. You can increase or decrease your deferral percentage, as well as make investment changes in the 457 Plan, the 401(k) Plan, or both.

The following how-to videos will take you through the various steps on how to access and make changes to your account.

How to Register Your Account for Online Access

This video walks you through the steps of registering for online access to your DCP account.

How to Enroll Online

This video walks you through the steps of enrollling in the NYC DCP and/or NYCE IRA.

How to View and Change Your Contributions Online

This video will show you how to review and modify your current contribution deferral percentage. It will also take you through the various screens to show you how to schedule a future dated contribution, either as a one-time or on-going contribution change.

Play the VideoHow to View and Manage Your Investments Online

This how-to video will walk you through where to find information about the Plan's investment options as well as view your personal rate of return. You will also be shown how to view and change your investment elections and how to make fund transfers.

Play the Video