Consumer and Worker Protection311

Consumer and Worker Protection311 Search all NYC.gov websites

Search all NYC.gov websites

File Your Taxes with NYC Free Tax Prep

Maximum credits. Full refund. Your family deserves it. Get it back.

If you earned $93,000 or less in 2024, file for FREE with an IRS-certified VITA/TCE volunteer preparer.

The IRS started accepting and processing 2024 tax returns on January 27, 2025. The deadline to file a tax return for your 2024 taxes is April 15, 2025.

Get Your Documents Ready! See a checklist of what you need to file your 2024 tax return.

NYC Free Tax Prep for Individuals and Families

In-Person Tax Prep and Drop-off Service

Online Tax Prep Service: GetYourRefund.org

GetYourRefund.org is a virtual program that connects filers to NYC Free Tax Prep providers to have their return completed for them in two different ways.

1. File virtually with an IRS-certified VITA/TCE preparer if you make under $66,000

Steps:

- Visit getyourrefund.org/nyc

- Sign into your account.

- Submit tax documents using your smartphone, tablet, or computer equipped with a camera.

- After all necessary documentation is submitted, an IRS-certified VITA/TCE preparer will verify your tax information and contact you.

- After speaking with a quality reviewer over the phone and signing the final version of your return, your quality reviewer will send your return to the IRS and New York State.

2. File quickly on your own using Get Your Refund's Free Filing software if you make under $79,000

Steps:

- Visit getyourrefund.org/nyc

- Scroll down to "File Myself" and begin the process.

Online Tax Prep Service: Virtual Tax Prep

Virtual Tax Prep is a safe and reliable online tax prep service. You must have access to a computer, tablet, or smartphone; a stable internet connection; and the ability to download secure video conference software. An IRS-certified VITA/TCE volunteer preparer will:

- help you file your 2024 tax return during a 60-90 minute virtual call;

- use a secure digital system to manage your tax documents;

- answer your tax questions.

List of Virtual Tax Prep Providers

Black Chamber of Commerce of New York City

Hours of Operation: Beginning February 3, 2025, Monday, Tuesday, and Friday 10:30 AM – 5 PM

Language(s): English, Spanish, Chinese – Mandarin, Haitian Creole, Bengali, Korean

Phone: 718-255-3322

Income Threshold: $65,000 or less without dependents or $80,000 or less with dependents.

BronxWorks

Hours of Operation: Beginning January 23, 2025, Monday 10 AM – 1 PM; Thursday 9 AM – 1 PM; Friday 11 AM – 5 PM

Language(s): English and Nepali

Website: bronxworkstaxes.as.me

Income Threshold: $65,000 or less without dependents or $93,000 or less with dependents.

Online Tax Prep Service: Assisted Self-Prep

Assisted Self-Preparation allows filers to complete their tax return online on their own and an IRS certified VITA/TCE volunteer preparer will be available by phone or email to answer questions. Filers will need access to a computer, tablet, or smartphone; a stable internet connection; an email address, and their 2023 adjusted gross income (AGI) or self-select PIN.

List of Assisted Self-Preparation Providers

Ariva

Hours of Operation: Beginning February 4, 2025, Tuesday 10 AM – 5 PM

Language(s): English and Spanish

Website: tax.ny.gov/tap/calendars/bookings-ariva.htm

Income Threshold: $84,000 or less.

COJO Flatbush

Hours of Operation: Beginning January 20, 2025, Monday and Wednesday 9 AM – 8 PM; Tuesday and Thursday 9 AM – 5 PM; Friday 9 AM – 1 PM; Sunday 12 PM – 5 PM

Language(s): English, Spanish, Chinese – Cantonese, Chinese – Mandarin, Haitian Creole, Bengali, Russian, Korean, Arabic, Armenian, Urdu, French, Hebrew

Phone: 718-377-2900 Ext. 331

Income Threshold: $65,000 or less without dependents or $93,000 or less with dependents.

Fedcap-SingleStop

Hours of Operation: Beginning January 27th, Monday – Friday 10 AM – 4:30 PM

Language(s): English, Spanish and Haitian Creole

Website: singlestop.org/how-to-make-an-appointment/

Income Threshold: $84,000 or less.

Grow Brooklyn

Hours of Operation: Beginning January 28, 2025, Monday – Friday 6 PM – 9 PM

Language(s): English, Spanish, Chinese – Cantonese, Chinese – Mandarin, Haitian Creole, Bengali, Russian, Korean, Arabic

Website:growbrooklyn.org/self-file/

Income Threshold: $65,000 or less without dependents or $93,000 or less with dependents.

LaGuardia Community College

Hours of Operation: Beginning February 6, 2025, Thursday 10 AM – 5 PM

Language(s): English and Spanish

Website: laguardia.edu/cares/

Income Threshold: $84,000 or less.

Medgar Evers College

Hours of Operation: Beginning February 7th, 2025, Friday 9 AM – 4 PM

Language(s): English and Spanish

Website: tax.ny.gov/tap/calendars/bookings-medgar-evers.htm

Income Threshold: $84,000 or less.

New York State

Hours of Operation: Beginning February 5, 2025, Wednesday 9 AM – 4 PM

Language(s): English and Spanish

Website: tax.ny.gov/tap/calendars/bookings-statewide-virtual-session.htm

Income Threshold: $84,000 or less.

File Directly with the IRS

IRS Direct File is a new service that allows taxpayers to file their taxes quickly, easily, and for free. Direct File will walk you through each step of filing your federal return in under an hour, using simple questions and plain language.

Starting January 27, 2025, you can use Direct File if your tax situation from 2024 was relatively simple, and you want to claim common credits like the EITC and the CTC. Direct File has a screener tool that will make sure it's the right tool for you before you start filing. Follow the steps below to use the IRS Direct File pilot.

Steps:

- Visit directfile.irs.gov on your computer, tablet, or phone to check your eligibility.

- If you're eligible, you'll need to create an ID.me account (Check-out this step-by-step guide in case you need help).

- Use the simple interview-style tool to complete your federal taxes.

- Once you complete your federal taxes, you’ll be taken to a free state filing system to complete your state return.

If you need help, live chat with a customer service representative who can help with technical support and basic tax law clarification in English and Spanish. Note: For security, customer service representatives will not have access to your IRS account data.

NYC Free Tax Prep for Self-Employed Filers

Year-Round Service for Small Business Owners, Freelancers, Gig Workers

Year-Round Specialized Tax Prep

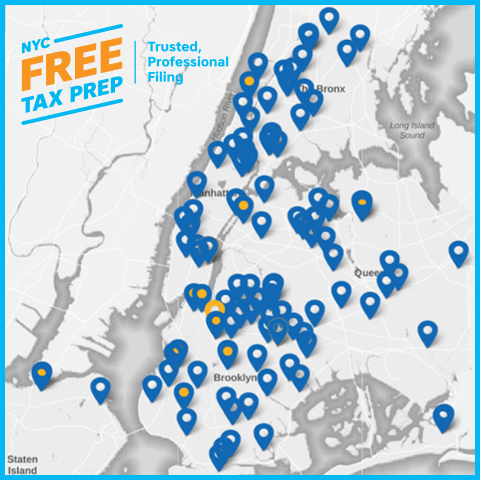

At select in-person NYC Free Tax Prep sites, knowledgeable preparers and enrolled agents sit down with you to complete an accurate personal and business return, including federal and New York State annual and quarterly estimated tax filings. This service is available to families with dependents who earned $93,000 and individuals or couples who earned $65,000 or less in 2023 and have business expenses of $250,000 or less. Use our NYC Free Tax Prep map to find sites that offer self-employed/Schedule C assistance.

Reminder: Please review the checklist of documents you will need to file your 2024 tax return at an NYC Free Tax Prep site specifically for the self-employed.

Workshops and Toolkits for Self-Employed Filers

If you work for yourself, you need to file taxes annually and make estimated tax payments quarterly.

Join our free Workshops (group sessions) to learn the basics of tax filing and recordkeeping best practices. View event calendar for upcoming workshops.

Want us to co-host a workshop for your organization or community? Submit a Workshop Request Form.

Our Toolkits + Tips can help you understand how self-employment taxes work and provide important information and recordkeeping templates that will help you prepare for the tax season. View toolkits for self-employed filers.

Learn more about the free resources DCWP offers freelancers, gig workers, and small business owners.

Additional Information

FAQs about NYC Free Tax Prep, ITIN and tax credits

Get Your Documents Ready! See a checklist of what you need to file your 2024 tax return.

Read FAQs about NYC Free Tax Prep.

Read FAQs about Individual Taxpayer Identification Number (ITIN).

Child Tax Credit (CTC). Earned Income Tax Credit (EITC). Child and Dependent Care Credit. Learn more about valuable tax credits.

The IRS provides tax filers with many helpful resources. Learn more at irs.gov.

Consumer Bill of Rights

By law, tax preparers must give you a copy of the Consumer Bill of Rights Regarding Tax Preparers before beginning any discussions about tax preparation services. Learn more.

Be a Volunteer Preparer

Become a volunteer preparer this tax season. You can have a real impact on New Yorkers’ lives. Learn how you can make a difference.

NYC Annual Tax Season Initiative

Since 2002, NYC Department of Consumer and Worker Protection (DCWP)—formerly the Department of Consumer Affairs (DCA)— has coordinated the City’s Annual Tax Season Initiative. Learn more about our campaign, our NYC Free Tax Prep Coalition Members, and how you can be a community partner.

This page was updated on 1/28/2025.